Affected by the rebound of COVID-19, the domestic economic development in the first half of 2022 was extremely unusual, and unexpected factors had a serious impact, especially the two-month blockade in Shanghai, which directly affected the overall economic situation in the second quarter, resulting in a significant increase in downward pressure.

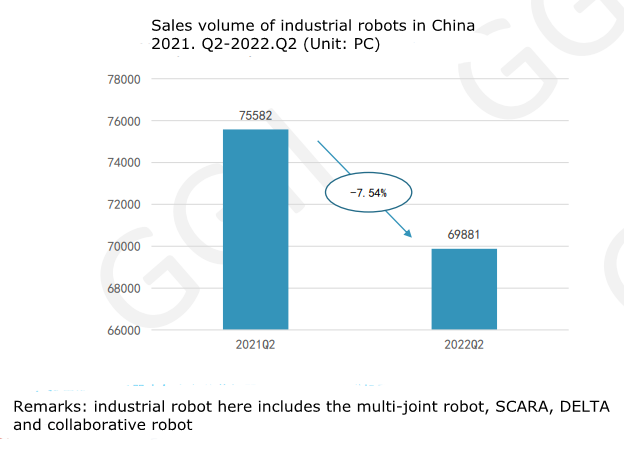

Affected by this, the sales volume of industrial robots 2022.Q2 in the domestic market also fell. According to the data of the robot industry Research Institute of Gaogong (GGII), the sales volume of industrial robots in the domestic market in the second quarter of this year decreased by 7.54% year-on-year, and the total shipment volume was 69881. Among them, domestic brands accounted for 38.46%; Foreign brands accounted for 61.54%.

According to GGII's analysis, in the second quarter, due to the impact of the Shanghai epidemic, the supply chain and logistics experienced a great test, and the sales volume of most manufacturers showed a downward trend. In particular, the manufacturers whose production centers and supply chain centers are in the Shanghai region were basically shut down from April to May and gradually recovered in June. The current core contradiction is still concentrated on the supply side.

The demand for the 3C electronic industry is sluggish, and SCARA is down 7.75% year on year.

From the perspective of product classification, GGII data shows that the SCARA robot and delta robot in the Chinese market in 2022.Q2 decreased by 7.75% and 9.81% respectively year-on-year. Among them, the sales of SCARA robots are 18036pcs, with domestic products accounting for 43.20%; the sales of delta robots are 1535pcs, with domestic products accounting for 59.20%.

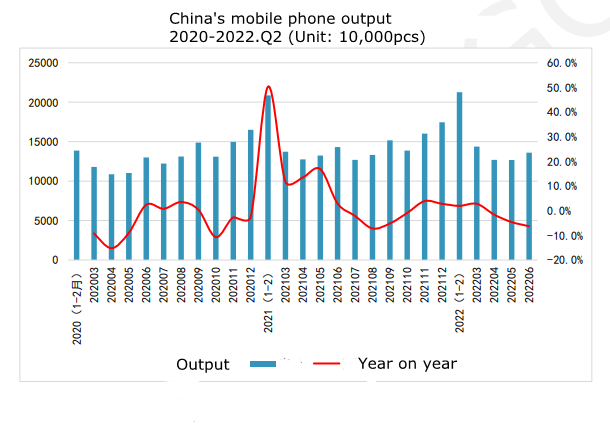

While the shipment of SCARA robots in Q2 declined because the demand of the electronic industry in its main market began to shrink significantly. According to GGII data analysis, in the second quarter of 2022, the year-on-year growth rate of China's mobile phone production dropped significantly, and it was below the critical point, with a year-on-year decline of 2.7%. From the perspective of microcomputer output, the year-on-year decrease in the second quarter of 2022 is 5.0%. In terms of integrated circuits, the year-on-year decline in the second quarter was 10%, and the decline was further expanded. The sluggish performance of the 3C electronics industry is mainly due to the sluggish transmission of the consumer end and the sharp reduction of smartphone orders.

The global electronics industry as a whole has entered a downward cycle, and the industry's prosperity has been greatly divided. The demand for consumer terminals such as smartphones and laptops is sluggish, affecting the demand for upstream storage chips, panels, and other parts, and further affecting the supply chain performance of enterprises related to the industrial chain.

The decline in the shipment of delta robot Q2 is also directly affected by the consumer side. The weak consumption leads to limited demand for food, daily chemicals, and other fields in the main market of demand. Meanwhile, the epidemic has also caused great resistance to the supply chain and delivery.

The collaborative robot 2022H1 showed brilliant performance, with an increase of 20.05%

Looking back at the data released by GGII in the first half of 2022, we can find that although the overall consumer demand is weak, the sales volume of industrial robots in the Chinese market still increased by 3.78% year-on-year. Among them, the growth rate of collaborative robots and medium and large load six-axis robots led the way, with 20.05% and 15.11% respectively. The small six-axis robots decreased by 6.27% year on year, the SCARA robots increased by 3.45% year on year, and the parallel robots decreased by 5.53% year on year.

In recent years, the domestic market share of domestic collaborative robot manufacturers has continued to expand. Taking 2022.Q2 data released by GGII as an example, the sales of collaborative robots in the Chinese market was 4678pcs, with a year-on-year increase of 8.77%; Among them, 3959pcs were made in China, accounting for 85.54%; 669pcs were produced by foreign companies, accounting for 14.46%. The market share of JAKA and AUBO exceeds 40%, the market share of UR further shrinks, and the second-tier enterprises are basically taken by domestic manufacturers.

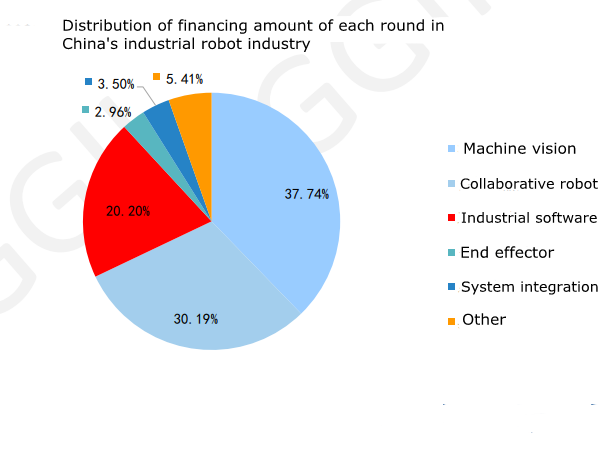

Collaborative robots not only lead in sales growth but also continue to be hot in financing. GGII data shows that in 2022h1, there were 41 financing events in the field of industrial robots in China, involving more than RMB 6.6 billion, of which the financing amount of cooperative robots accounted for 26.47%, only slightly lower than that in the field of machine vision.

The growth rate of the domestic industrial robot market is expected to exceed 20% in the second half of the year.

In the third quarter, the shortage of parts and components was gradually alleviated, especially the chips, and the output of China's industrial robots began to increase slightly. In this regard, Lu Hanchen, director of the Robotics Industry Research Institute of Gaogong, also said: "in the second half of the year, there was no 'big increase' as expected. The fatigue on the demand side is beginning to show, and the pressure and challenges are still enormous."

At the same time, GGII has also predicted that the growth rate of the domestic industrial robot market in the second half of the year will exceed 20%, and the annual sales volume is expected to be 303000, with a year-on-year increase of 15% - 20%.

From the current perspective, the growth rate of new energy is still strong, and it constitutes one of the few niche products with a positive growth rate in the first half of the year with lithium batteries and photovoltaic cells. In addition, the biggest change comes from the automobile field. The transformation of automobile electrification has reached a key node. The certainty has been further consolidated. The investment in the automobile field has begun to usher in new growth. It is expected that the demand for robots will continue to increase.