![EDH)P89K]$TOI@E4BRM](Y8.jpg EDH)P89K]$TOI@E4BRM](Y8.jpg](/upload/admin/20220905/1cf0014f26cefb9c99e416a4474f36ff.jpg)

Going abroad has always been a great strategic feat that domestic brands are keen on. Since the reform and opening up more than 40 years ago, all walks of life in China have written a strong new chapter in China's economy from "introducing" to "going out". The trend of replacing "foreign goods" with domestic goods is gradually intensifying. In the past two years, this trend has also begun to appear in the field of robots.

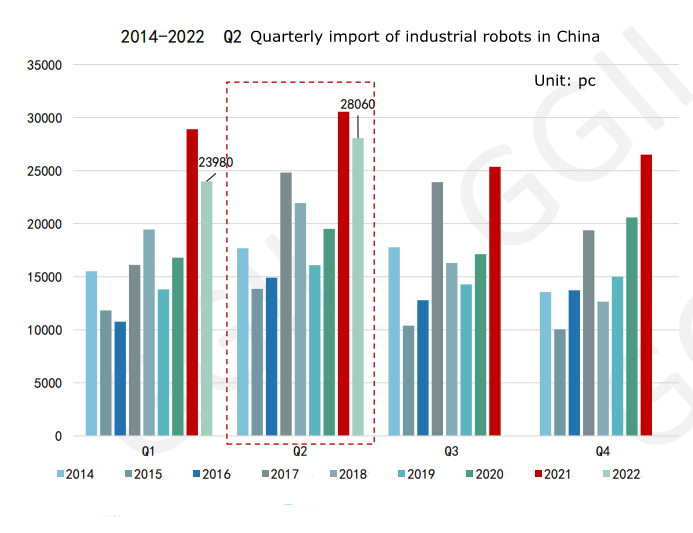

According to data from GGII, the number of imported industrial robots in China in Q2 of 2022 was 28,060pcs, a year-on-year decrease of 8.13%, a month-on-month increase of 17.01%, and a year-on-year decrease of 12.46% in the cumulative import volume in the first half of the year. Compared with Q2 of 2021, there are fewer manufacturers achieving year-on-year growth in Q2 of 2022, among which FANUC and Staubli are the representatives. Due to the comprehensive impact of the epidemic in Shanghai and the supply chain, most manufacturers have declined significantly yearly.

Taking foreign brands FANUC and Yaskawa as examples, GGII data show that the business revenue of Yaskawa Q2 in China decreased by 31.6% year-on-year, and the business revenue of North America and other Asian countries increased by more than 30% year-on-year. In the first quarter of FANUC (Note: Based on Japan's fiscal year, i.e. the data from April to June of that year), some parts of China were blocked, and it was difficult to obtain relevant parts, resulting in serious disruption of the supply chain. In addition, the cost of parts and maritime transportation, and other expenses surged, resulting in a negative impact on its operating profit. In order to maintain the profit margin of the enterprise, FANUC's product price rose. This also provides breathing space for Chinese local robot manufacturers and a good opportunity to overtake in curves.

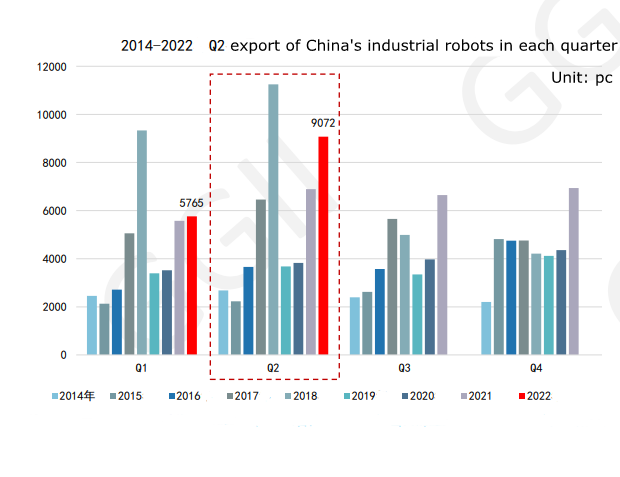

In sharp contrast to imports, the export data is particularly bright. GGII data show that in Q2 of 2022, China's export of industrial robots was 9072, an increase of 31.63% year-on-year and 57.36% month on month.

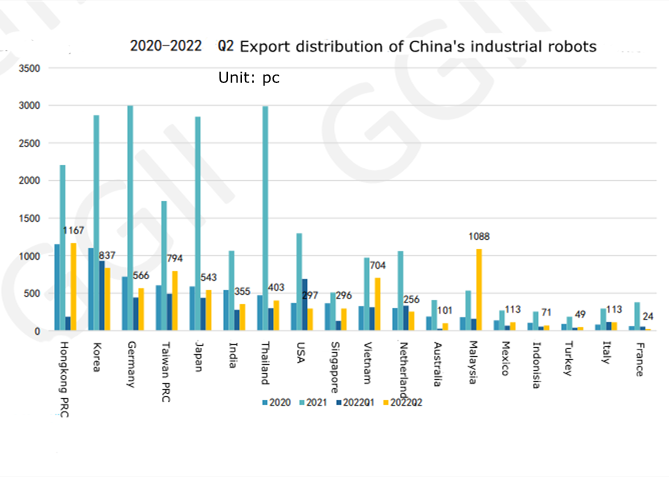

From the perspective of major export regions, the top five major export regions in Q2 2022 are: Hong Kong, China (1167pcs), Malaysia (1088pcs), South Korea (837pcs), Taiwan, China (794pcs) and Vietnam (704pcs).

Overall, in Q2 of 2022, China's export of industrial robots increased significantly. More and more robot manufacturers increased their overseas layouts. Southeast Asia, represented by Vietnam, undertook part of the global manufacturing capacity, driving a new round of investment growth.

When domestic enterprises go abroad, they generally face five major problems, namely, business environment, management mode, team building, cost composition, and risk management.

(1) Business environment

The business environment involves all aspects. Take the handling of a business license as an example. It may take a few days to complete all the registration and review processes of a business license in China, but in India, it can take as long as three years and as short as one year to register a company, which is a very long process. There will be many problems involved here, such as capital injection, investment approval, foreign plant leasing, etc. the waiting period is very long.

(2) Management mode

Because of different living habits and social ways, there will be huge differences in some office software and internal approval processes. For example, after many enterprises go to sea, they will suddenly find that they can't get microcredit, which also leads to many large domestic enterprises suffering from "maladjustment" after going out.

(3) Team building

For overseas enterprises, team building is the top priority. In the early stage of going overseas, 3C electronic enterprises such as Huawei and ZTE also faced this problem. The biggest obstacle for enterprises to set up teams overseas is social customs and habits, which is not only a problem of language communication but also a different way of thinking. For example, in India, their people are very direct, but we Chinese are more implicit, so when we think that he is angry, in reality, he just wants to clarify the problem.

(4) Cost composition

Compared with domestic products, the cost composition of overseas products is particularly complex. When overseas customers see your products, they will ask you how much it costs at once. At this time, it is difficult for many people to say, because it includes domestic costs, tariffs, and other income taxes. Many enterprises are stuck at this point and cannot make overseas quotations.

(5) Risk management

Anti-risk ability is actually a touchstone, which can quickly detect the grasp of enterprises going to sea on all uncertain factors such as local policies, politics, and exchange rates, as well as specific countermeasures. In the face of these uncertain risks, let go directly and select a reliable and capable local person to be in charge of the factory. Even though because of the epidemic, we can't go abroad, the factory still kept normal operation and could ensure continuous growth every year.

In addition, our enterprises should also pay attention to the selection of overseas suppliers. Take a glass door as an example, a Chinese supplier quotes RMB 7,000, and local suppliers in India only need RMB 1,700.

Therefore, in conclusion, first, invest cautiously. Overseas risks are huge. 90% of the enterprises that come back from India should be dead, and 10% can barely survive. Second, our entrepreneurs should have the mentality of starting a second business. Many domestic peers and big bosses went abroad and come back immediately because they are not acclimatized, do not understand the language, and do not have good living habits. It is equivalent to starting from zero there. If they do not have the mentality of starting a business, going overseas is very difficult; Third, it's very hard to start a business overseas, including the problem of the time difference and the challenges to deal abroad. Most of the time, you are isolated and helpless. Once you choose, you must go all out.

Since 2019, the export volume of China's industrial robot industry has increased year after year, and even increased by more than 90% year-on-year in 2021. In addition, the domestic market has now become the world's largest robot consumption market, and stimulated by the migration demand for 3C electronics, new energy vehicles, and so on, some domestic robot manufacturers have become particularly aggressive in the face of overseas markets, trying to use the power of capital to encircle overseas markets.

Faced with such a situation, domestic manufacturers need to think calmly. Although the export growth rate has increased year after year, there is still a huge deviation between imports and export from the overall quantity. Domestic robot brands need to face up to their shortcomings. Under the situation that core technology is still backward, we need to find the "new core" of the brand, and replace blind "rampage" with hibernation, so as to achieve the future.